New Delhi, July 21 – In a major digital identity reform, the Unique Identification Authority of India (UIDAI) has announced the end of OTP based Aadhaar verification for Know Your Customer (KYC) processes. Instead, individuals can now verify identity through a secure QR code or an offline PDF file, eliminating the need for Aadhaar numbers, biometric data, or OTPs.

This revolutionary move is being hailed as a win for both privacy protection and user convenience, particularly for those living in remote areas or facing mobile connectivity issues. The upgrade not only enhances the user experience but also aligns with the government’s broader push for data minimization and digital privacy.

What Changes in Aadhaar Verification?

Until now, Aadhaar verification for KYC involved sharing the 12 digit Aadhaar number and receiving a one time password (OTP) on the linked mobile number. This process was often hindered by poor connectivity, number mismatches, or privacy concerns.

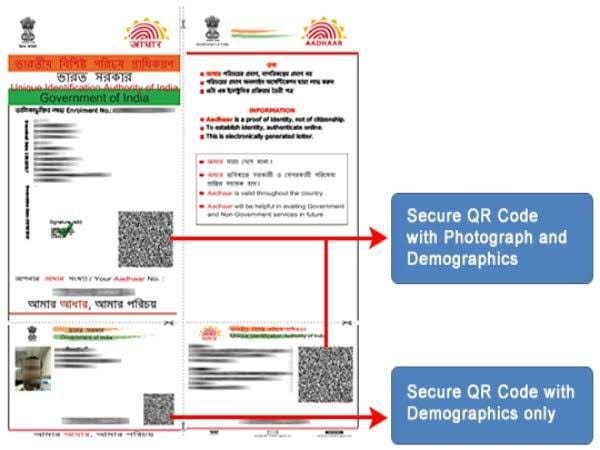

With the new mechanism, users can download a masked Aadhaar PDF or scan a secure QR code embedded with demographic details such as name, date of birth, gender, and a photograph. This offline KYC process doesn’t require revealing the Aadhaar number, nor does it ask for biometrics or OTPs offering a safer and faster way to complete identity checks.

How Does the New Aadhaar KYC Work?

1. QR Code KYC: Users can generate a secure QR code from their mAadhaar app or official UIDAI website. This code includes non sensitive demographic information.

2. Masked Aadhaar PDF: Users can download a password protected, digitally signed PDF file that hides the full Aadhaar number and contains only the last four digits.

3. Offline Sharing: Both formats are designed for offline sharing, meaning users can carry out KYC processes without any internet connection or mobile OTP dependency.

4. Verification: Agencies or companies can use UIDAI’s tools to scan and verify the QR code or PDF authenticity instantly.

This approach makes Aadhaar verification accessible even in rural areas or for people with limited access to smartphones or stable networks.

Privacy and Security Reinforced

UIDAI emphasized that this system is built on the principles of data minimization and privacy first design. Since it doesn’t store or transmit the full Aadhaar number or biometric information, the risk of misuse is significantly reduced.

Importantly, service providers are prohibited from storing the offline KYC files or the data extracted from them. This ensures that users’ identities are not misused post verification.

Easier for Service Providers Too

For telecom operators, banks, NBFCs, fintechs, and other institutions requiring KYC, the offline Aadhaar verification process is a game changer. It reduces the dependency on API integrations, lowers operational costs, and simplifies compliance burdens. Verifiers no longer need to obtain licenses for biometric based Aadhaar authentication.

Moreover, the QR and PDF based verification ensures quick onboarding without delays caused by failed OTPs or technical issues.

Aadhaar Verification Use Cases

- Opening a bank account

- Mobile SIM activation

- Government subsidy applications

- Educational enrollments

- Insurance and loan processing

With these reforms, all the above services can now verify identity using secure, non-intrusive, offline methods.

Official Statement from UIDAI

A UIDAI spokesperson stated:

“This upgrade to Aadhaar verification is a major leap in user centric design and privacy. Citizens now have complete control over what data they share and how.”

The authority also clarified that OTP and biometric based verification will still be available for those who choose to use them. However, the new offline options will now serve as the default Aadhaar KYC tools for most everyday needs.

Final Thoughts

As Aadhaar verification enters its next chapter, UIDAI’s adoption of QR code and PDF-based offline KYC marks a pivotal shift towards digital inclusion, privacy preservation, and tech-driven governance. For millions of Indians, especially those in rural or underserved regions, this could remove longstanding roadblocks in accessing vital services.

Stay Connected with The News Drill for more updates.

Source: UIDAI, PIB, Digital India