New Delhi – 24 July, 2025: The Unified Payments Interface (UPI), India’s leading digital payment system, is about to see major updates from August 1, 2025. The new UPI rules aim to ease pressure on banking servers, reduce network congestion, and improve transaction efficiency for millions of users. The National Payments Corporation of India (NPCI) has introduced these changes in response to the exponential rise in UPI transactions across the country.

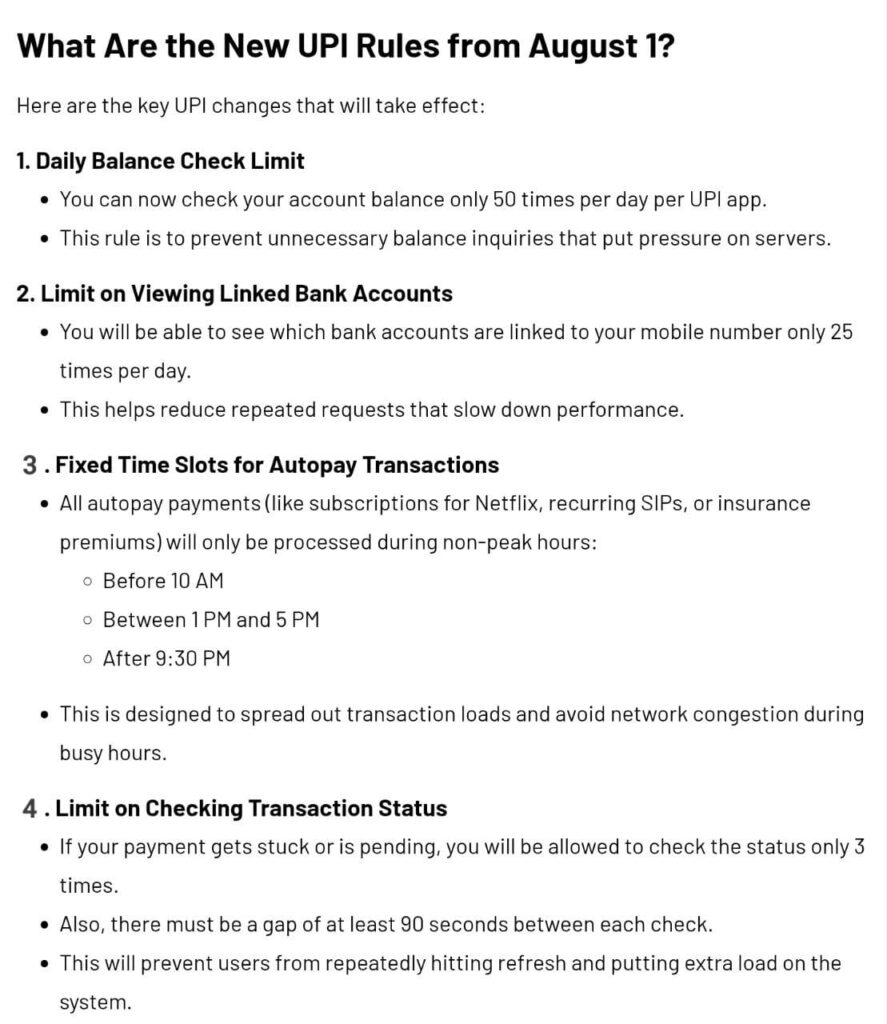

Here’s a breakdown of what’s changing under the new UPI rules from August 1:

1. Daily Balance Check Limit: Under the new UPI rules, users will be able to check their bank account balance only 50 times per day per UPI app.This change comes as a measure to prevent excessive, unnecessary balance inquiries that strain banking servers. Many users often refresh balance information multiple times a day, especially during peak hours. By capping this feature, the authorities aim to optimize server usage and improve overall system stability.

2. Limit on Viewing Linked Bank Accounts: Users will now be allowed to view which bank accounts are linked to their mobile number only 25 times per day.This change is part of the new UPI rules that focus on reducing system overload caused by repeated requests. Users frequently cross check their linked bank accounts for safety, which leads to additional processing pressure on UPI platforms. The restriction is designed to curb excessive traffic and enhance system speed.

3. Fixed Time Slots for Autopay Transactions: In a major shift, autopay transactions such as those for recurring payments including Netflix subscriptions, SIPs, or insurance premiums will now be processed only during non peak hours. The permitted time slots are:

- Before 10 AM

- Between 1 PM and 5 PM

- After 9:30 PM

According to NPCI, these time slots have been chosen to spread out transaction loads, thereby avoiding network congestion during peak banking hours. The new UPI rules will ensure smoother processing for both users and financial institutions.

4. Limit on Checking Transaction Status: Another important update under the new UPI rules is the limitation on checking the status of a transaction.

If a UPI payment is stuck or pending, users will now be able to check its status only three times. Furthermore, there must be a minimum gap of 90 seconds between each status check.

This update discourages users from repeatedly hitting the “refresh” button, which often contributes to network overloads and delays in other transactions.

Why These Changes Matter: With UPI processing over 10 billion transactions monthly, these rule changes are crucial. According to NPCI, the new UPI rules are geared toward improving overall system performance and ensuring smooth experiences for users even during peak times.

The exponential growth of UPI, driven by its convenience and integration with various platforms, has led to unforeseen pressure on backend servers. These changes are expected to reduce unnecessary requests and ensure the availability of services when they are truly needed.

Final Thoughts: The new UPI rules effective from August 1 are a proactive step to address growing digital payment demands in India. Users are advised to adapt to the changes and use UPI services more responsibly.

If you rely heavily on UPI for daily banking, these limits might feel restrictive initially. However, they are designed with long term benefits in mind, aiming to make the digital payment ecosystem more resilient and efficient.

Stay Connected for updates on digital payment systems, government tech regulations, and financial services, stay tuned to The News Drill.

Contact us: contact@thenewsdrill.com

Submit story tips: editor@thenewsdrill.com

1. What is the new limit for checking UPI balance per day?

As per the new UPI rules, users can check their account balance only 50 times per day per UPI app. This is to reduce unnecessary server load.

2. How many times can I view my linked bank accounts in a day?

You will be allowed to view which bank accounts are linked to your mobile number only 25 times per day.

3. When will UPI autopay transactions be processed?

Autopay transactions (like Netflix, SIPs, insurance) will be processed only during non-peak hours:

Before 10 AM

Between 1 PM to 5 PM

After 9:30 PM

4. How many times can I check the status of a stuck UPI transaction?

You can check the transaction status only 3 times, and each check must be spaced at least 90 seconds apart.

5. Why are these new UPI rules being implemented?

These changes aim to reduce server pressure, optimize network performance, and improve overall transaction efficiency due to the growing number of UPI users.