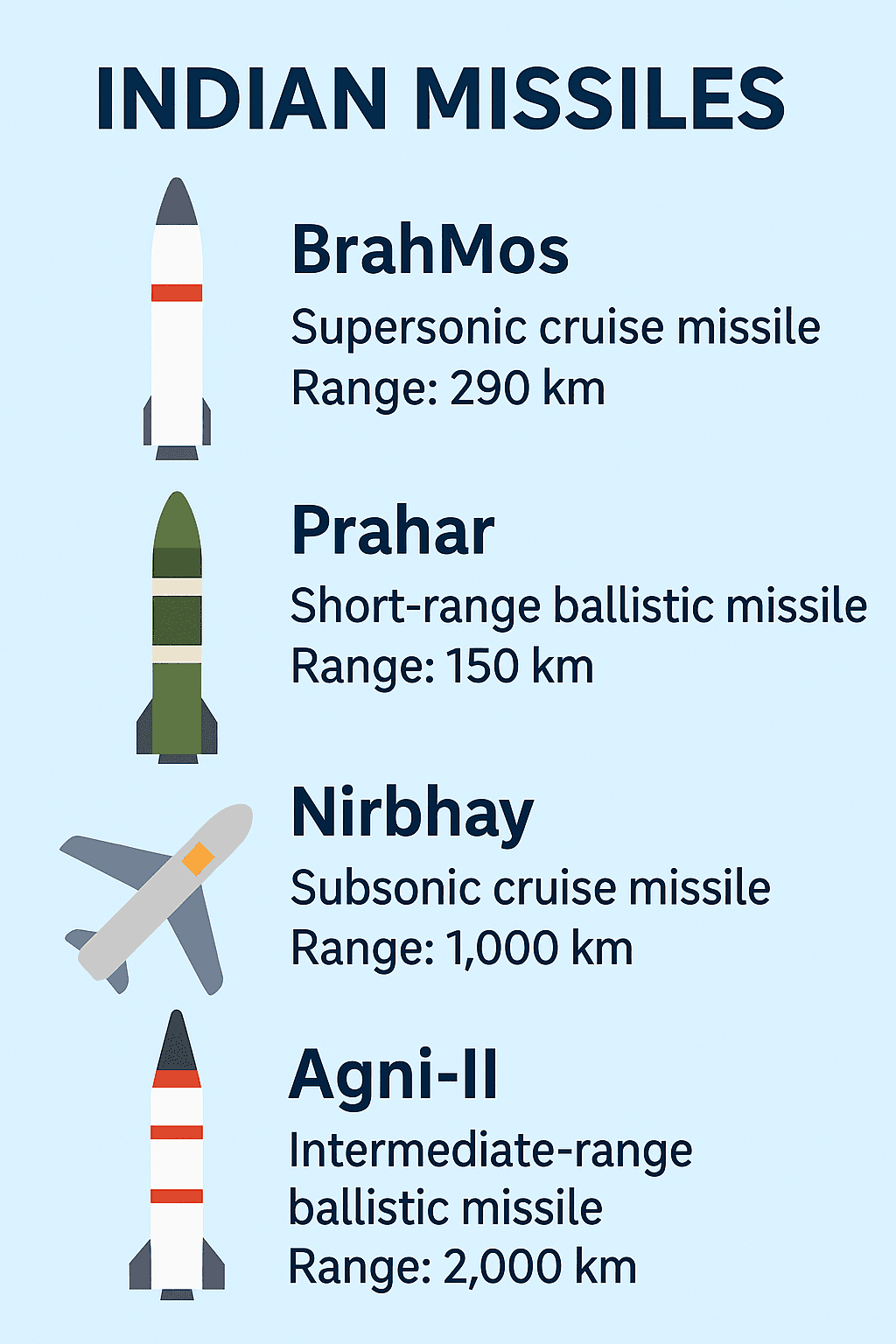

New Delhi, 22 July, 2025 – India is facing an unprecedented surge in cyber crime targeting elderly people, with digital fraudsters preying on vulnerable senior citizens who often lack tech literacy. According to the National Crime Records Bureau (NCRB), cybercrime cases have skyrocketed over the last five years, with 2022 seeing 65,893 registered cases more than double the figures from 2018.

- Why Elderly People Are Easy Targets for Cyber Criminals

- Common Types of Cyber Crime Targeting Elderly People

- 1. Phishing & Impersonation Scams

- 2. Fake Tech Support Calls

- 3. ATM and UPI Fraud

- 4. Investment Scams & Ponzi Schemes

- Real Life Examples: How Scammers Cheat the Elderly

- Government Measures to Tackle Cyber Crime Targeting Elderly People

- What Can Families Do to Protect Elderly Loved Ones?

- Legal Recourse for Elderly Cyber Crime Victims

- Way Forward: Digital Inclusion With Safety

- Senior Safety Is Digital India’s Responsibility

Explosive Rise in Cybercrime Cases (2018–2022)

The NCRB data paints a grim picture of how cyber crime targeting elderly people is becoming a major concern in India:

| Year | Cyber Crime Cases Registered |

|---|---|

| 2018 | 27,248 |

| 2019 | 44,735 |

| 2020 | 50,035 |

| 2021 | 52,974 |

| 2022 | 65,893 |

While the statistics represent all cybercrime incidents, law enforcement and cyber experts confirm a sharp increase in cases involving elderly victims, particularly related to digital banking, phishing, OTP frauds, and impersonation scams.

Why Elderly People Are Easy Targets for Cyber Criminals

In today’s increasingly digitized world, cyber crime targeting elderly people is on the rise due to multiple factors:

- Limited digital literacy among senior citizens.

- Dependence on children or caretakers for online services.

- Greater trust in calls or messages that appear official.

- Loneliness or cognitive decline making them more vulnerable to manipulation.

Cyber criminals exploit these weaknesses using psychological tricks, fake bank calls, and social engineering to extract sensitive information.

Common Types of Cyber Crime Targeting Elderly People

Here are some of the most common ways in which elderly Indians are falling victim to cyber fraud:

1. Phishing & Impersonation Scams

Elderly individuals often receive fake emails or SMS messages from what seems like their bank, asking them to “verify” personal details. These messages contain dangerous links that steal sensitive data.

2. Fake Tech Support Calls

In this scam, callers pretend to be from companies like Microsoft, asking elderly users to download software that gives remote access. Once inside, fraudsters steal money or lock files for ransom.

3. ATM and UPI Fraud

Many senior citizens have been duped into sharing OTPs and card numbers over calls. A Hyderabad based 74 year old retired teacher recently lost ₹5.8 lakh to a caller pretending to be from his bank’s fraud department.

4. Investment Scams & Ponzi Schemes

With promises of high returns on FD like schemes, scammers lure elderly people into investing through fake websites. By the time the victim realizes the fraud, the website and scammers vanish.

Real Life Examples: How Scammers Cheat the Elderly

🔹 Case 1: Pune Senior Loses ₹12 Lakh

In 2022, a 69 year old retired Air Force officer in Pune was tricked by a fake insurance policy renewal email. He shared personal details and later found ₹12 lakh missing from his bank account.

🔹 Case 2: Bengaluru Woman Scammed on WhatsApp

A 67 year old woman in Bengaluru received a WhatsApp message with a “government pension bonus” link. She clicked it and unknowingly gave scammers access to her UPI app. ₹1.4 lakh was siphoned off in minutes.

Government Measures to Tackle Cyber Crime Targeting Elderly People

The government has begun to acknowledge the seriousness of cyber crime targeting elderly people. A few initiatives include:

- Cybercrime Helpline 1930: The Ministry of Home Affairs launched a centralized cybercrime complaint helpline for quick redressal.

- Cyber Dost: The government’s cyber safety Twitter handle (@Cyberdost) shares educational content to raise awareness among all age groups, especially senior citizens.

- Digital Literacy Campaigns: Programs like PMGDISHA aim to train people in rural and semi-urban areas, including the elderly, on basic digital safety.

However, experts argue these efforts need more targeted outreach, especially in Tier 2 and Tier 3 cities.

What Can Families Do to Protect Elderly Loved Ones?

Here are actionable tips to prevent cyber crime targeting elderly people in your family:

1. Regularly Educate Them: Explain common scams and ask them to be cautious of unknown calls, messages, or emails.

2. Install Safe Browsing Tools: Use antivirus software and browser filters to prevent access to malicious websites.

3. Enable Transaction Limits: Set UPI and online transfer limits to reduce financial risk.

4. Use Joint Bank Accounts: With limited online access for the elderly, this can help monitor any unusual activity.

Legal Recourse for Elderly Cyber Crime Victims

Victims of cyber crime targeting elderly people must take swift action to increase the chances of recovery. Here’s what to do:

1. Call 1930 Immediately: Reporting within the first hour improves chances of freezing transactions.

2. File an FIR: Visit the nearest police station or cybercrime cell.

3. Report on Cybercrime.gov.in: This government portal allows you to file complaints from home.

You can also seek help from organizations like Cyber Peace Foundation and HelpAge India, which have started offering legal and digital counseling for affected seniors.

Way Forward: Digital Inclusion With Safety

As India pushes for a Digital India, the elderly must not be left behind or made collateral damage. While technology can empower, lack of preparedness can devastate. The state must initiate dedicated awareness programs, community outreach, and user friendly digital security tools for the elderly.

The massive surge in cyber crime targeting elderly people is not just a law enforcement issue it’s a societal failure to protect the most vulnerable. Unless preventive steps are taken on war footing, thousands of elderly citizens will continue to suffer silently.

Senior Safety Is Digital India’s Responsibility

With 65,893 cybercrime cases reported in 2022, the rising wave of cyber threats is no longer a fringe problem. The elderly are being hit the hardest due to their limited knowledge of modern tech risks.

The fight against cyber crime targeting elderly people must be multi pronged blending strong cyber laws, public awareness, and digital empathy. As scammers evolve, so must our systems and societies.

Until then, the simple rule stands:

If you don’t recognize it — don’t click it, don’t share it, and don’t trust it.”

Sources: PIB Report and NCRB Report.