UPI Surpasses Visa: Becomes World’s #1 Real Time Payment System in Just 9 Years.

- UPI Surpasses Visa: What This Means for the Global Economy

- The Numbers Behind the Shift

- What Makes UPI So Powerful?

- Global Expansion Despite Limited Footprint

- UPI’s Role in India’s Financial Inclusion

- Experts Weigh In: Why UPI Surpasses Visa Is Just the Beginning

- Visa Reacts to UPI Surpasses Visa Trend

- What’s Next for UPI?

- Conclusion: A Watershed Moment in Fintech History

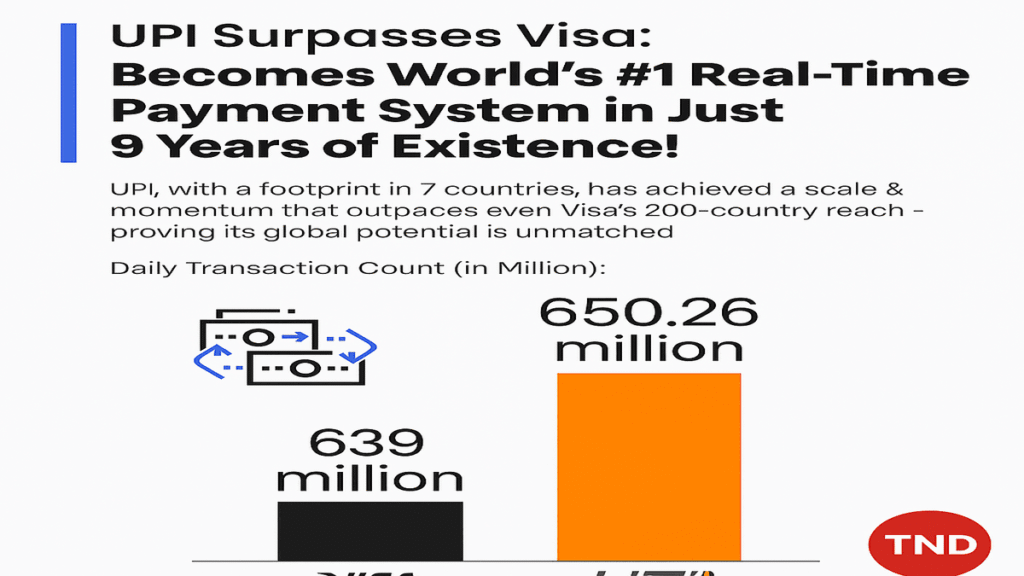

Unified Payments Interface (UPI) has created a historic milestone by surpassing global giant Visa to become the world’s number one real-time payment system in terms of daily transaction volume. In just nine years since its inception, UPI surpasses Visa with a staggering 650.26 million daily transactions compared to Visa’s 639 million, marking a defining moment in the global digital payments revolution.

UPI Surpasses Visa: What This Means for the Global Economy

The news that UPI surpasses Visa has not just caught the attention of the Indian fintech sector but has echoed globally, symbolizing a paradigm shift in digital finance. While Visa has a presence in over 200 countries, UPI is currently operational in only seven countries yet it has outpaced Visa’s daily transaction volume, underscoring the explosive growth and potential of India’s digital infrastructure.

This growth is not merely a statistical triumph; it signals India’s emerging dominance in fintech innovation and the increasing global reliance on real time payment systems.

The Numbers Behind the Shift

According to recent data, the daily transaction count for:

- Visa: 639 million

- UPI: 650.26 million

The rise of UPI surpasses Visa in this metric not only emphasizes scalability but also demonstrates the efficiency, low cost, and accessibility of India’s home grown payment platform.

What Makes UPI So Powerful?

Developed by the National Payments Corporation of India (NPCI), UPI enables instant money transfers between bank accounts through mobile devices. Unlike traditional card based systems like Visa, UPI:

Eliminates intermediaries such as card networks or wallets.

Offers zero cost transactions for most users.

Supports a wide ecosystem of apps including PhonePe, Google Pay, Paytm, and BHIM.

Provides an open source platform accessible to banks and fintech players alike.

This makes UPI a faster, cheaper, and more inclusive option for billions of users.

Global Expansion Despite Limited Footprint

Despite being live in only seven countries including Singapore, UAE, Bhutan, Nepal, Sri Lanka, France, and Mauritius UPI surpasses Visa in volume, highlighting the unmatched efficiency of India’s digital backbone.

NPCI International is currently in talks with several countries to enable UPI based cross border payments. As these partnerships grow, UPI’s international influence is expected to expand rapidly, potentially altering the balance of power in global financial systems.

UPI’s Role in India’s Financial Inclusion

The success story of UPI surpasses Visa is deeply rooted in India’s digital inclusion push, especially under initiatives like:

- Digital India

- Jan Dhan Yojana

- Aadhaar integration

- RBI’s pro digital policies

These programs enabled millions of unbanked and underbanked citizens to enter the formal financial ecosystem using just a smartphone and a bank account. Today, UPI transactions are used to pay vendors, utility bills, transfer salaries, and more even in the most remote corners of India.

Experts Weigh In: Why UPI Surpasses Visa Is Just the Beginning

Fintech experts see this achievement not as an endpoint, but as the beginning of a new digital payments era.

“The fact that UPI surpasses Visa despite limited international reach shows that the model is globally scalable,” says Ankit Agarwal, a fintech analyst at Bengaluru based Digital Pulse.

“It’s fast, free, and built for interoperability something legacy systems like Visa are still adapting to.”

Analysts also point to the open API framework and government backing as key reasons for UPI’s rapid rise. As more countries explore alternatives to expensive card networks, India’s UPI is likely to be their go to model.

Visa Reacts to UPI Surpasses Visa Trend

While Visa continues to be a leader in international credit and debit card services, the company is now actively investing in real time payment infrastructure. They have launched initiatives to stay competitive but acknowledge the threat posed by platforms like UPI.

Visa CEO Ryan McInerney has noted the importance of “adapting to the shift in consumer payment preferences,” and analysts believe Visa may have to collaborate with or integrate real time solutions like UPI to stay relevant.

What’s Next for UPI?

Now that UPI surpasses Visa, the next milestones include:

- International partnerships to enable cross border UPI transactions.

- Merchant adoption abroad, especially in tourism heavy countries.

- RBI backed credit on UPI, which could challenge even credit card companies.

- Offline and voice based UPI, to include rural and elderly populations.

Conclusion: A Watershed Moment in Fintech History

The moment UPI surpasses Visa is more than a numerical achievement. It is a testament to India’s innovation, the efficiency of public-private collaboration, and the possibilities of scalable digital ecosystems.

In just nine years, UPI has gone from a domestic experiment to the world’s most used real time payment system, reshaping the landscape of global digital payments. If this momentum continues, UPI may soon not just rival traditional giants it could replace them in the modern financial order.

Stay Connected with The News Drill for more updates on global fintech, digital payments, and India’s financial innovations. Stay informed. Stat updated. Stay Ahead.

Em us: contact@thenewsdrill.com

Submit tips or guest articles: editor@thenewsdrill.com