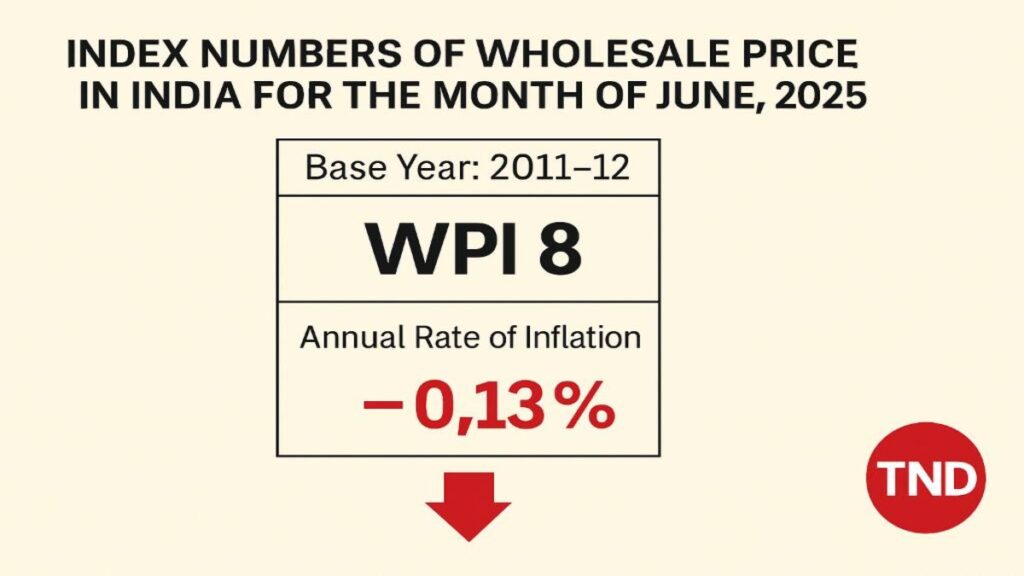

India’s Wholesale Price Index (WPI) for June 2025, with base year 2011–12, reflects a negative annual inflation rate of -0.13%, according to provisional data released by the Ministry of Commerce and Industry. This marks a continuation of the downward trend in wholesale inflation, primarily attributed to falling prices in food articles, mineral oils, crude petroleum, and basic metals.

- What Is the Wholesale Price Index?

- Key Highlights of the Wholesale Price Index June 2025

- Sector Wise Performance

- Impact of Negative Inflation

- RBI’s Viewpoint: Focus on Balanced Inflation

- Agricultural Impact and MSP Dynamics

- Global Context: Commodity Prices Slump

- Statistical Summary

- Expert Opinion

- Policy Outlook Ahead

- Conclusion: A Data Point With Mixed Signals

The Wholesale Price Index June 2025 figures suggest a significant cooling off in prices across primary sectors, driven largely by global commodity trends, domestic supply chain corrections, and reduced demand in certain manufacturing segments. For policymakers, producers, and consumers alike, this data paints a complex but important picture of India’s wholesale price dynamics.

What Is the Wholesale Price Index?

The Wholesale Price Index (WPI) measures the average change in prices of goods at the wholesale level. Unlike the Consumer Price Index (CPI), which measures retail level inflation, WPI gives a broader view of price movements at the bulk trade level. It tracks three major groups:

- Primary Articles (like food, crude oil, etc.)

- Fuel and Power

- Manufactured Product

The WPI is a crucial economic indicator that helps the Reserve Bank of India and other financial institutions determine monetary policy, including interest rates.

Key Highlights of the Wholesale Price Index June 2025

Annual WPI inflation rate (June 2025 vs. June 2024): -0.13%

- This is the fourth consecutive month of WPI deflation.

- Food articles saw a sharp price decline, particularly vegetables and cereals.

- Fuel & power group, including mineral oils and crude petroleum, registered a negative growth.

- The manufacturing sector, especially basic metals, contributed significantly to the disinflation.

Sector Wise Performance

1. Primary Articles

- The index for primary articles declined substantially in June 2025.

- Food articles like onions, tomatoes, and pulses saw excess supply due to a good monsoon and improved logistics, pulling down prices.

- Some agricultural prices dropped by more than 10% YoY.

This had a significant bearing on the Wholesale Price Index June 2025, with food inflation turning negative, reversing last year’s upward trend.

2. Fuel and Power

- Mineral oils, electricity tariffs, and crude petroleum prices all saw notable reductions.

- Global oil prices were relatively subdued due to increased U.S. shale production and slow demand from China.

- Domestic fuel prices also fell marginally due to tax adjustments.

This drop in energy costs provided relief for manufacturers but also contributed to the overall WPI decline.

3. Manufactured Products

The index for manufactured products registered a decline, particularly in:

- Basic metals

- Chemicals

- Textile products

Export linked sectors saw price corrections due to global softening in demand.

The WPI for basic metals saw a YoY drop of around 1.5%.

Impact of Negative Inflation

A negative Wholesale Price Index June 2025 does not necessarily mean all is well. While it can bring temporary relief to consumers, sustained deflation can signal broader economic concerns:

Pros:

- Lower input costs for industries

- Temporary price relief for consumers

- Lower inflation pressure on monetary policy

Cons:

- Reduced profit margins for producers

- Weak demand scenario across sectors

- Possible contraction in industrial output

Economic planners must interpret the Wholesale Price Index June 2025 with caution, as prolonged deflation can discourage investment and reduce GDP growth.

RBI’s Viewpoint: Focus on Balanced Inflation

The Reserve Bank of India (RBI) primarily uses the Consumer Price Index (CPI) to set monetary policy, but the Wholesale Price Index June 2025 data provides supporting evidence for the overall inflation environment.

Given the CPI inflation in June 2025 stood at 3.8%, the divergence between wholesale and retail inflation points to supply chain bottlenecks and retail markup issues. The RBI is expected to maintain a neutral to slightly accommodative stance in the upcoming monetary policy meet.

Agricultural Impact and MSP Dynamics

A deflationary Wholesale Price Index June 2025 may impact farmers, particularly those relying on open market sales. While Minimum Support Prices (MSPs) remain assured for certain crops, non-MSP produce may not fetch good returns.

Agricultural economists have raised concerns that deflation in food prices might discourage sowing decisions for the Kharif season. A corrective market intervention may be necessary to prevent farmer distress.

Global Context: Commodity Prices Slump

The global commodity market has witnessed a price correction since early 2025:

- Metal prices (especially iron ore and copper) fell due to declining construction activity in China.

- Oil prices dropped to $71/barrel from last year’s average of $82/barrel.

- Food grains saw stable to declining prices due to good harvests in Brazil, India, and parts of Africa.

These global trends heavily influenced the Wholesale Price Index June 2025, especially in fuel and primary goods.

Statistical Summary

| Group | YoY Inflation (June 2025) |

|---|---|

| All Commodities | -0.13% |

| Primary Articles | -1.58% |

| Fuel & Power | -2.31% |

| Manufactured Products | -0.46% |

| Food Articles (within PA) | -2.42% |

Source: Office of the Economic Adviser, Ministry of Commerce & Industry, GoI

Expert Opinion

Dr. Raghav Mehta, Senior Economist at NCAER, notes:

“The Wholesale Price Index June 2025 reflects a mixed picture. While lower prices ease cost burdens for industries, sustained negative inflation isn’t a healthy sign for a growing economy. The government must stimulate demand through capital expenditure and social welfare spending.”

Policy Outlook Ahead

Given the fall in the Wholesale Price Index June 2025, several policy level implications may follow:

- Interest rates may remain unchanged or slightly reduced.

- Government spending may increase to boost demand.

- Import tariffs on certain products might be revised to protect domestic industries.

- Monsoon dependent agriculture schemes may receive more attention.

The government is also expected to recalibrate its National Logistics Policy to ensure smoother market linkages that prevent food gluts and price crashes.

Conclusion: A Data Point With Mixed Signals

The Wholesale Price Index June 2025 with a -0.13% inflation rate offers an intriguing window into India’s macroeconomic trends. While low prices sound good for the average citizen, persistent negative inflation could hurt producers, farmers, and exporters.

Policymakers must tread carefully using this data to inform decisions on fiscal policy, interest rates, and subsidies. As India continues to walk the tightrope between inflation and growth, the WPI trends will remain a critical economic signal.

Stay Connected with The News Drill for more updates. Stay informed. Stay updated. Stay Ahead.

Have a tip, opinion, or question about India’s economic data? Submit your story: editor@thenewsdrill.com

For press inquiries: contact@thenewsdrill.com📢 Publish with TND | The News Drill and make your voice count.