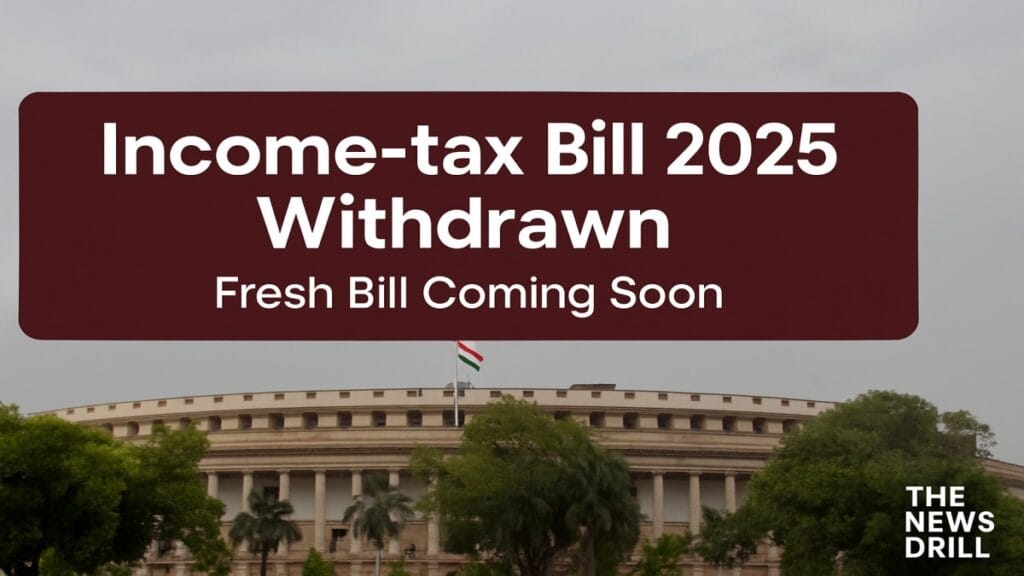

New Delhi, August 8, 2025 – In a significant legislative development, the Central Government has withdrawn the Income tax Bill 2025 that was earlier introduced in the Lok Sabha on February 13, 2025. The decision comes after a comprehensive review of the Select Committee’s report and further feedback suggesting improvements for clarity in the legal framework. A new version of the Bill is expected to be introduced soon to eventually replace the archaic Income tax Act, 1961.

- Why Was the Income tax Bill 2025 Introduced?

- Timeline of the Income tax Bill 2025

- Why Did the Government Withdraw the Income tax Bill 2025?

- Select Committee’s Role and Recommendations

- What’s Next: Fresh Income tax Bill in the Works

- Income tax Bill 2025: What It Aimed to Do

- Analysis: A Strategic Retreat, Not a Setback

- Political Reactions

- What It Means for Taxpayers

- Conclusion

This move signals the government’s willingness to incorporate broader consultations and legislative refinement before overhauling India’s direct tax regime.

Why Was the Income tax Bill 2025 Introduced?

The Income tax Bill 2025 was introduced as part of the government’s long-standing commitment to reform the outdated Income tax Act of 1961, which has been in force for more than six decades. The new Bill was aimed at:

- Simplifying the tax code

- Enhancing compliance and transparency

- Aligning tax provisions with modern economic realities

- Making taxation easier for both individuals and corporates

Finance Minister Nirmala Sitharaman, while introducing the Bill in February, emphasized that the proposed legislation would make India’s tax system more predictable and investor friendly.

Timeline of the Income tax Bill 2025

| Date | Event |

|---|---|

| Feb 13, 2025 | Income-tax Bill 2025 introduced in Lok Sabha |

| Feb 13, 2025 | Bill referred to a Select Committee for review |

| July 21, 2025 | Select Committee submits its report to Lok Sabha |

| Aug 8, 2025 | Government announces withdrawal of the Bill |

Why Did the Government Withdraw the Income tax Bill 2025?

While the Select Committee’s report was generally favorable, the Government highlighted the following reasons for the withdrawal:

1. Need for Greater Legislative Clarity

Some of the suggestions received post report highlighted ambiguities that could potentially hinder the interpretation of several provisions in the Income tax Bill 2025. These included definitional inconsistencies, cross referencing errors, and alignment issues with international tax treaties.

2. Broader Consultations and Stakeholder Feedback

Various industry bodies, tax professionals, and state governments provided additional feedback after the Committee report was tabled. The government acknowledged that these inputs were substantive and would improve the Bill’s robustness if duly incorporated.

3. Avoiding Legal Challenges

Given the possibility of judicial scrutiny over loosely worded clauses or technical lapses, the government likely chose caution. Withdrawing the Bill allows the Centre to introduce a more refined version that minimizes litigation risk.

4. Political Consensus and Smooth Passage

With several Opposition MPs raising concerns over tax definitions, assessment procedures, and centralization of powers in the Income tax Bill 2025, the government possibly decided to revisit the provisions to ensure cross party consensus for smooth passage in both Houses.

Select Committee’s Role and Recommendations

The Select Committee consisted of representatives from various political parties and was tasked with examining the Bill’s provisions in detail. It laid its report in the Lok Sabha on July 21, 2025. According to sources:

- Most of the Committee’s recommendations were accepted by the Government.

- Some technical, legal, and procedural recommendations were marked for further review.

- The Committee emphasized transparency, taxpayer rights, and digitization in its suggestions.

What’s Next: Fresh Income tax Bill in the Works

The withdrawal does not mark an abandonment of tax reforms, but rather a strategic pause to improve the draft legislation. The Ministry of Finance confirmed that:

“A fresh Income tax Bill will be introduced in due course, incorporating most of the Select Committee’s recommendations along with suggestions received to ensure the correct legislative intent.”

This means stakeholders can expect a more balanced and legally sound version of the Income tax Bill 2025 to be introduced in the upcoming Winter Session of Parliament or possibly earlier through a special session.

Income tax Bill 2025: What It Aimed to Do

The now withdrawn Income tax Bill 2025 proposed several key reforms:

- Revamped tax slabs and rates for individuals and HUFs

- Simplified capital gains taxationRationalization of deductions and exemptions

- Greater powers for the National Tax Tribunal

- Increased digitization of tax processes and assessments

- Stronger anti-abuse provisions targeting tax evasion

The government had pitched the Bill as a “21st century tax framework” designed to match the New India’s economic vision.

Analysis: A Strategic Retreat, Not a Setback

Policy experts and political observers believe that the withdrawal is a course correction rather than a failure.

➤ “Legislative Refinement Is Smart Governance”

Constitutional expert notes:

“Withdrawing a bill after receiving meaningful feedback is not a sign of weakness but of deliberative democracy. It’s better to delay than rush a law that will impact every Indian citizen.”

➤ “Stakeholder Driven Lawmaking”

According to CII (Confederation of Indian Industry), the move is a positive signal that the government is listening to taxpayers, businesses, and professionals.

Political Reactions

Ruling Party (BJP)

BJP spokesperson hailed the withdrawal as a “mature and transparent step” to ensure that the law is not passed in haste.

Opposition Reactions

The Congress and other opposition parties claimed this as a legislative misstep, with MP Shashi Tharoor saying:

“Introducing a major tax bill without internal consensus and withdrawing it within months raises questions on legislative planning.

What It Means for Taxpayers

While the withdrawal of the Income tax Bill 2025 delays tax reforms, the government has clarified that:

- The existing Income tax Act, 1961 remains in force.

- No disruptions will occur in ongoing assessments, refunds, or returns.

Taxpayers may expect a more refined law that is easier to comply with and less prone to disputes.

Conclusion

The withdrawal of the Income tax Bill 2025 underscores the complexities of overhauling a decades-old tax framework in a diverse and complex economy like India. While the government has embraced most of the Committee’s suggestions, it is going the extra mile to refine the draft further aiming for legal accuracy, administrative efficiency, and broad consensus.

A new Income tax Bill, better aligned with stakeholder expectations and constitutional integrity, is now on the horizon.

Stay connected with The News Drill for more updates.